Dear Reader,

The third edition of Spotlight traces the Turbulence in the Indian Skies following the consecutive failure of two major airlines in India. We look forward to hearing your thoughts and suggestions.

TURBULENCE IN INDIAN SKIES

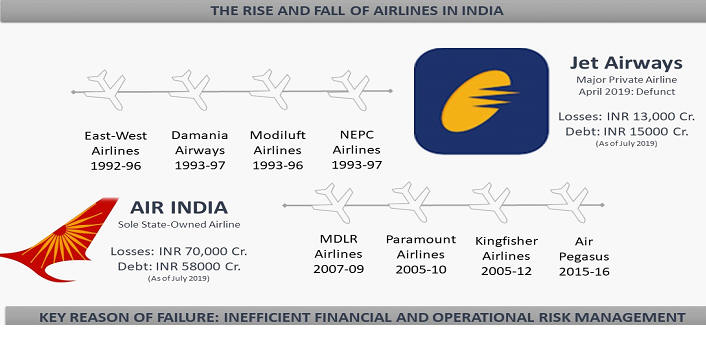

India’s domestic aviation story is one of sharp paradoxes. While air travel has exploded in India, the health of the Indian airlines has not kept pace with that growth. Over the years, the civil aviation sector has witnessed the rise and fall of many airlines.

A TALE OF TWO AIRLINES: THEY FLEW, THEN FALTERED

Air India

In March 2018, the government unuccesfully initiated divestment process for Air India, calling for bids to acquire a 76 % stake in the sole state-owned airline. The government had constituted an Air India Specific Alternative Mechanism (AISAM) in June 2017 to oversee the strategic disinvestment of Air India. However, it was decided that due to issues like volatile crude oil prices & adverse fluctuations in exchange rates the atmosphere was not conducive for the disinvestment. Recently, the government transferred about Rs 29,000 crore of working capital debt into Air India Asset Holdings (AIAHL), a special purpose vehicle and also reinitiated the divestment process of the airlines.

Jet Airways

The market share of Jet Airways fell from 44% in 2003-04 to 10% in 2019 owing to a massive debt pile of $1.1 billion and failure to pay loans, thereby leading to it ceasing its operations and battling insolvency petitions. Jet’s debt crunch can be attributed to its acquisition of Air Sahara along with its debts for $500 million in cash, soaring jet fuel prices and highly crushing price wars with low cost carriers (Indigo, Spicejet, GoAir etc.). This was further heightened by the poor financial and operational management of the airlines which failed to attract the right strategic investors, even when it was at the cusp of a shutdown.

The fate of Jet Airways resonates with that of Kingfisher Airlines, a privately owned high flyer which ended its operations in 2012 after failing to clear its dues to banks, staff, lessors and airports.

The Battle of Indian Airlines with Aviation Turbine Fuel (ATF)

ATF accounts for over 40% of Indian airlines’ operational expenses as opposed to the global average of 24%, creating an uneven level playing field for them vis-à-vis international carriers. Since jet fuel is imported and priced in dollars, the global strength of US currency adds to escalated costs. Further, domestic carriers pay 11% excise duty on ATF with State level taxes going as high as 30%. This has raised the demand from domestic carriers to bring ATF within the ambit of Goods and Services Tax.

Not only does it make it difficult for incumbent Indian airlines to grow; high fuel costs also pose a barrier to entry for new air carrier service providers to enter India‘s civil aviation market.

MID AIR CRISIS: INEFFECTIVE RISK MANAGEMENT

In many ways, the plight of Air India and the demise of Jet Airways are symptomatic of India’s aviation woes largely driven by ineffective financial and operational risk management with far reaching consequences on the economy.

- Airlines are exposed to significant financial risks which create uncertainty of future cash flow and have a material impact on the functioning of airlines.

- Fluctuations in interest rates, default on loan repayments, negative cash flow generation, adverse movements of foreign exchange currency prices, or fluctuations of commodity prices, airlines’ operating and financial expenditures (such as the aviation turbine fuel).

- The operational risk portfolio encompasses a wide variety of challenges that need to be constantly re-adjusted for capacity rationalisation and route, network or hub optimisation.

- Revenue and inventory management, promotion and distribution of services and products, cost containment, human resources policies, and IT and telecommunications systems, among others.

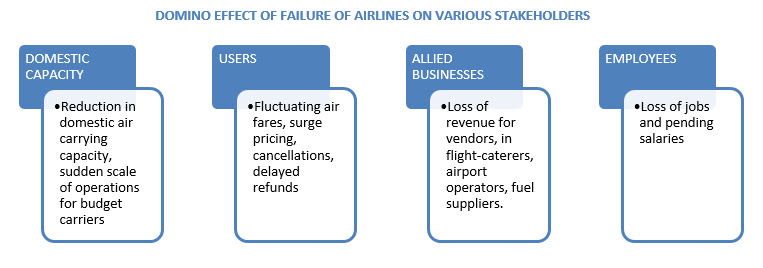

It is natural for airlines, akin to enterprises across other sectors, to be confronted with risks. Unfortunately, risks are often recognised too late, not leaving enough time or adequate measures available to prevent the consequential damage from the realisation of the risk potential. Such failures have widespread implications on the economy.

To prevent this, airlines should aim at recognising possible risks and mitigating them through adequate strategic or surgical measures. On the regulatory front in curbing such risks, the role of Director General of Civil Aviation has been minimal thus far. In order to reduce systemic risks faced by airlines, which could trigger instability in the entire economy, it is pertinent for regulators to undertake systematic and targeted policy interventions to ensure a robust functioning of airlines.

Should the Aviation sector be left to survive on its own means?

A healthy civil aviation sector is expected to provide optimal benefits from tourism, trade and investment for the economy, protect of consumer interests and enhance competition. Letting the market take its course in the event of failure of airlines and adoption of a hands off approach by the government will have widespread repurcussions on the economy.

Should National carriers be prevented from failing?

National carriers often hold a substantial market share in a country and are closely associated with the country’s global image. Examples can be drawn from Airlines such as Air Canada, Austrian, Delta, Japan Airlines, Olympic, Northwest, Swissair, United and US Airways which were all given substantial lifelines by their respective governments against potential collapse.

Should the ownership and control limits of airlines be raised?

Akin to most economies, India does not permit foreign majority ownership of Indian air carriers capping it at 49%. Being a highly capital intensive business, not only these curbs limit access to finance for indian airlines but also impede access to the Indian markets for foreign carriers to the detriment of the economy. In todays era of globalisation and transnationalism, it contributes to delayed maturity of the civil aviation industry.

Should air transport be considered an essential service/ public utility?

The assurance of essential services/ public utilities is considered to be the domain of the State. It usually encompasses services indispensable to life (water, electricity and gas supplies). However countries such as Australia, Europe and the US have incorporated an essential services provision whereby airlines are provided support in the form of a financial subsidy or exclusive concessions to maintain a specified level of air service between specified points.

Should airlines be considered to be ‘too big to fail’?

The Civil Aviation industry is characterized by a number of complex interactions and interdependencies between stakeholders. Owing to the size, complexity, interconnectedness, and critical functions of the aviation sector, shutting shop of a key market player (such as Jet Airways) has adverse economic consequences and widespread impact on various stakeholders. Akin to banks and financial institutions, airlines should also be considered too big to fail.