The Economic Times, July 18, 2020

By Amol Kulkarni and Rishi Agrawal

The clarion call of Atmanirbharta by the Prime Minister led to a few states suspending labour regulations to attract large industries. The assumption being big businesses are repelled by archaic labour laws, and temporarily doing away with them will automatically make such states an easier place to run a business.

Unfortunately, the reality is not so simple. Big businesses look for low cost inputs, raw materials, ancillary services, and value addition, which micro, small, and medium enterprises (MSMEs) are capable of providing. Consequently, we must ask if we have been able to make our MSMEs atmanirbhar and capable of playing such a role. The answer sadly is no.

A typical MSME in Maharashtra with an office and a factory, around 100-150 employees, and likely turnover in the range of Rs 10-20 crore, is required to obtain 27 different types of registrations in order to start operations. Around a third of these are labour related.

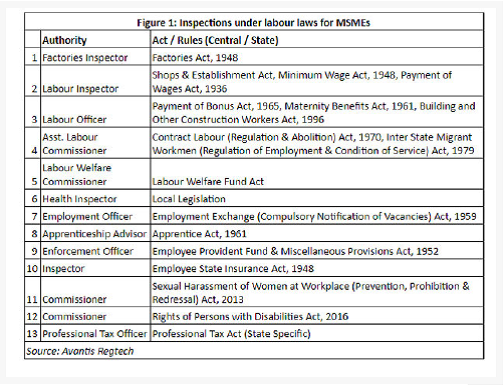

Moreover, at any given point in a year, around 20 different types of inspectors/ officers/commissioners are authorised to visit such MSME for inspections. As Figure 1 shows, 13 of these are authorised under labour laws.

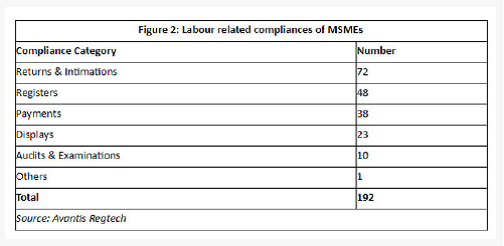

As if this was not enough, a typical MSME is required to deal with 364 compliances in a year i.e. one compliance a day, with adverse consequences including penalties and imprisonments, in some cases of non-compliances. Of these, 194 are labour related, as figure 2 shows. Several such returns, intimations, and payments are required to be filed/ paid on a monthly basis, without much rationale.

The state of affairs is such that different labour regulations require maintaining similar registers, albeit in different formats. For instance, a wage register is required to be maintained in different formats under five different legislations. Similarly, the accident register is required to be maintained under three different regulations. Despite the technological progress, we haven’t been able to achieve consistency in register formats.

The annual cost of such compliances for a typical MSME is around Rs 12 lakh i.e. Rs 1 lakh per month. Not surprisingly, cost of complying with labour regulations make substantial portion of this cost, at around Rs 4.58 lakh per annum. This is a result of ambiguous rules and complexities involved in compliances, which force MSMEs to rely on external consultants, including CAs, CS’, advisors, lawyers, and experts. While big businesses are able to comfortably outsource compliance management, this is quite expensive for MSMEs who are required to divert substantial resources, which could have been otherwise invested in their businesses.

Unfortunately, we are yet to realise that cost of compliance for MSMEs is disproportionately higher, and may often derail MSMEs journey towards self-reliance. Despite our focus on ease of doing business over the years, we haven’t been able to simplify compliances for our MSMEs so that they can confidently and directly deal with government, without intermediaries and the need to invest substantial time and efforts.

Notwithstanding the above, a sledgehammer approach to suspend labour laws, even for MSMEs, is not justified. Such easy to implement measures are not thought through and may adversely impact employees. Maintaining health, safety, economic and social security standards for employees should be paramount for any organisation.

It is therefore necessary to take a nuanced and practical approach to optimize and rationalise labour regulations for MSMEs. This could happen by reviewing the compliances on a three-step test of legality, necessity, and proportionality, conducted through robust stakeholder consultation, and analysis of costs and benefits of compliances on different stakeholders, including MSMEs and workers. Only those compliances which pass all the three criteria, should be retained.

This first step in this approach will be to identify the source of compliance, and check if the compliance is beyond the scope of primary legislation. The ultra-vires compliances should be immediately scrapped. The second step will be to understand the objectives and ask if the compliance is really serving any purpose. For instance, what is the rationale for having different formats of wage and accident registers and why can’t a single format meet the objective. Similarly, what is rationale for monthly filings and payments, and why can’t MSMEs be given an option to choose between monthly and quarterly modes. The result will be reduction in duplicity and achieving rationalisation. The third step will be to examine if the mode of compliance is proportional to objectives being achieved. For instance, why is there a need for physical applications, payments and inspections when digital modes can achieve the same level of efficiency with lesser costs and efforts. The result will be digitisation of processes, inspections, and payments to make life easier for MSMEs. Moreover, to optimise inspections, a mix of self and third-party certification ecosystem, on the lines of Pollution Under Control certification model could be envisaged.

The time is ripe to optimize labour regulations for MSMEs the right way, and respond to PMs call of atmanirbharta. Big bang announcements without much substance may lead to contrary results.

Amol Kulkarni is Director (Research) at CUTS International and Rishi Agrawal is Co-Founder and CEO of Avantis Regtech.

This news item can also be viewed at: